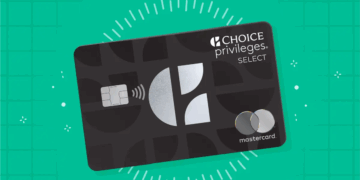

How to Apply for Choice Privileges Select Mastercard Credit Card

Unlock travel rewards with the Choice Privileges Select Mastercard Credit Card. Earn points on all purchases, enjoy exclusive perks at Choice Hotels, and pay no foreign transaction fees. Take advantage of tempting introductory offers and robust security features for a rewarding and worry-free travel experience.

Apply for M1 Owners Rewards Credit Card Step-by-Step Guide

The M1 Owner's Rewards Credit Card offers up to 10% cashback on select purchases when investing with M1, with no annual fees. Seamlessly integrate with the M1 Finance ecosystem and enjoy exclusive investment bonuses as an M1 Plus member, enhancing both savings and investment strategies.

How to Adapt Your Life Plan in Times of Financial Crisis

Facing a financial crisis can be overwhelming, but adapting your life plan is essential. By assessing your financial situation, prioritizing essential expenses, and establishing an emergency fund, you can navigate uncertainty. Explore new income opportunities and regularly review your plan to enhance resilience and prepare for future challenges.

Investing for the Future: How to Start Thinking About Retirement

Effective retirement planning starts with setting clear goals and understanding your financial needs. Assess your lifestyle preferences and calculate potential expenses. Explore diverse investment options, practice patience, and consider professional guidance. Start saving early to enjoy a secure and fulfilling retirement, aligning your strategy with your unique journey.

The importance of patience in building an investor mindset

This article emphasizes the crucial role of patience in investing, highlighting how a long-term perspective and emotional control can lead to sustainable financial growth. By avoiding impulsive decisions and focusing on a disciplined approach, investors can navigate market fluctuations and enhance their chances for success over time.

How to automate expense tracking with technology

Automating expense tracking streamlines financial management by utilizing technology for real-time data entry, bank integration, and expense categorization. These tools not only save time but also enhance budgeting efforts and provide valuable insights, empowering better financial decisions and fostering long-term financial health.

Credit Card as a Tool for Control, Not for Debt

Credit cards can be powerful tools for financial control when used wisely. By managing spending, building credit, and taking advantage of rewards programs, individuals can avoid debt and cultivate financial stability. A disciplined approach fosters a healthy relationship with credit, turning potential burdens into valuable assets.

How to turn dreams into goals within your life plan

Discover how to transform your dreams into actionable goals through a structured life plan. By clarifying aspirations, setting SMART goals, and creating an action plan, you can achieve fulfillment and success. Embrace the journey, celebrate progress, and adapt as needed to cultivate a purpose-driven life.

What to consider before making your first investment in stocks

Investing in stocks requires careful evaluation of your financial situation, setting clear goals, and understanding your risk tolerance. Research different stock types, diversify your portfolio, and choose the right investment account. Utilizing technology can further enhance your experience, guiding you towards informed decisions for financial growth.

Visualization Techniques to Attract Financial Abundance

This article explores how visualization techniques can transform your financial journey. It highlights methods such as vision boards, meditation, affirmations, and gratitude practices to clarify goals, maintain focus, and foster a mindset of abundance. By integrating these techniques, you can attract financial success and enhance your overall fulfillment.